What is Accountancy and Finance

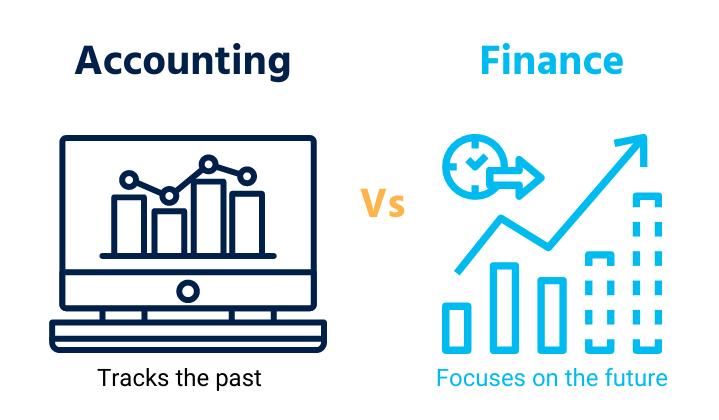

Accountancy and finance is the management of money and business. Finance looks at the future. It is the process and strategy of how a company or organisation can plan its resources and project the outcome of its actions- the return on its investments. Accounting focuses on the actuals; it keeps track of the results and activities of the plans made by finance and the running of the business.

These two areas, which work together, are fundamental for a business to succeed at any scale. All organisations rely on career professionals to track, manage and optimise their investments, resources and liabilities.

Professionals in this field are required to hold relevant qualifications. We have collated online finance courses that you can search through to get an idea of the qualifications available.

Routes into Financial Accounting

There are multiple pathways to work your way to the top of the profession in finance and accounting. For example, you could study the subject at degree level and then move into a graduate role within a large organisation.

Alternatively, you could start in an entry-level position in an accounting or finance team and gain professional certification as your career progresses.

Both of these routes require certification. In fact, there is a lot of crossover between university and professional accreditation in finance and accounting. As a result, you will often find that having one type of certificate will make the holder eligible for credits of waivers on modules on the other.

For example, a course with modules accredited by the ACCA can be used to give an exemption from taking ACCA Foundation Paper F1. This can significantly speed up the process of becoming a fully chartered accountant.

Undergraduate Qualifications

Accounting and finance degrees give students the foundation for a career in this area. Students will gain an understanding of the main business skills. Most courses will typically cover the following areas

- Business law

- Financial markets

- Auditing

- Management accounting

- Taxation

- Microeconomics

- Banking & investment

- Corporate finance

Entry requirements

You would generally need good A levels, including maths. However, some universities may accept other relevant level-3 qualifications. For mature students, you may be able to supplement your application with relevant work experience if you are already working in a finance or accounting role.

Professional Certification

Many roles in finance and accounting require industry certification to be able to practice. The most well known and respected are:

- Association of Accounting Technicians (AAT) qualification

- Association of Chartered Certified Accountants (ACCA) qualification

- The ICAEW Chartered Accountant (ACA) qualification

- Chartered Financial Analyst (CFA)

- Chartered Institute of Management Accountants (CIMA) professional qualification

Once certified, professionals need to keep their knowledge and skills up to date by demonstrating additional learning each year, known as Continual Professional Development or CPD for short.

There are also a number of degree and master’s courses that incorporate some form of professional certification into the programme.

Master’s Degree Specialisations

A master’s in finance and accounting is often a requirement for specific roles in the sector. Many of these courses focus on a particular area within the profession. Example titles include

- International Banking and Finance

- Internal Audit Management and Consultancy

- Insurance and Sustainable Risk Management

It is also quite common to find that a master’s can shorten the time and work required to gain a professional certificate. Conversely, students who already hold an ACCA or CIMA may be exempt from needing to take some modules on a Master’s.

Entry requirements

To gain a place in an accounting or finance master’s, applicants usually need an undergraduate degree at 2:2 or higher in a relevant subject area. Some courses may also ask for relevant career experience in some programmes.

CPD Certification

CPD courses are given a notional amount of hours of study time. Many accounting and finance professionals who hold a licence to practice must demonstrate a certain amount of learning each year.

These courses tend to be shorter, some only lasting a few hours up to a few months. You can search finance CDP courses using the certificate options filters.

Entry requirements

Entry requirements for CPD courses vary but usually require relevant career experience and or a good level of numeracy.

Professional Accountancy Bodies and Chartered Institute

The leading professional bodies in the UK that set the industry standards and oversight are:

- Association of Chartered Certified Accountants (ACCA)

- Chartered Institute of Management Accountants (CIMA)

- Chartered Institute of Public Finance and Accountancy (CIPFA)

- Institute of Chartered Accountants in England and Wales (ICAEW)

- Institute of Chartered Accountants of Scotland (ICAS)

These organisations provide a wide range of advice and governance to professionals.

Accounting and Finance Salary Expectations

Finance and accounting professionals are in demand in all areas of the UK. Entry-level positions start at around 20K, while salaries for CFOs start around 200K in London. As you would expect, there is a wide range of roles and salaries. Hays have a good breakdown from 2021 to give you an idea of the most common types of roles and salaries.